“The key to your sale or investment strategy is to help non-social care sector investors understand your business. To do this, you need to embrace the benefits of rigorous data analysis.”

John Lanyon, Co-Founder and Chairman of KareInn digital care planning, is a volunteer member of Alzheimer’s Society Research Network, a former carer, and a corporate finance advisor to multiple businesses in the UK and Internationally. John founded KareInn to deliver tangible outcomes for people living with dementia.

John is also an operational excellence champion and an expert at building successful investment partnerships. In his article, he explains what care home businesses need to do, to improve their financial performance and to make themselves investment or sale ready.

To the outside world, Care Homes have always represented a deceptively simple business, and yet those familiar with the sector know that running a profitable and sustainable care home business is a fiendishly difficult challenge.

The sector has attracted capital providers over the years who have got burnt, precisely because the business ‘looks’ so simple. These failures have caused many investors to stay away from the sector; stunting the vital investment needed in the industry and fueling the funding challenges the sector faces.

However, by understanding and being able to communicate the nuance of your business model, your niche, and how this compares to others, you will be left in a much stronger position to be able to manage your care home business. This might be externally; with banks or funding bodies, or even internally with your own teams. In a post-covid world, this additional layer of control can be vital.

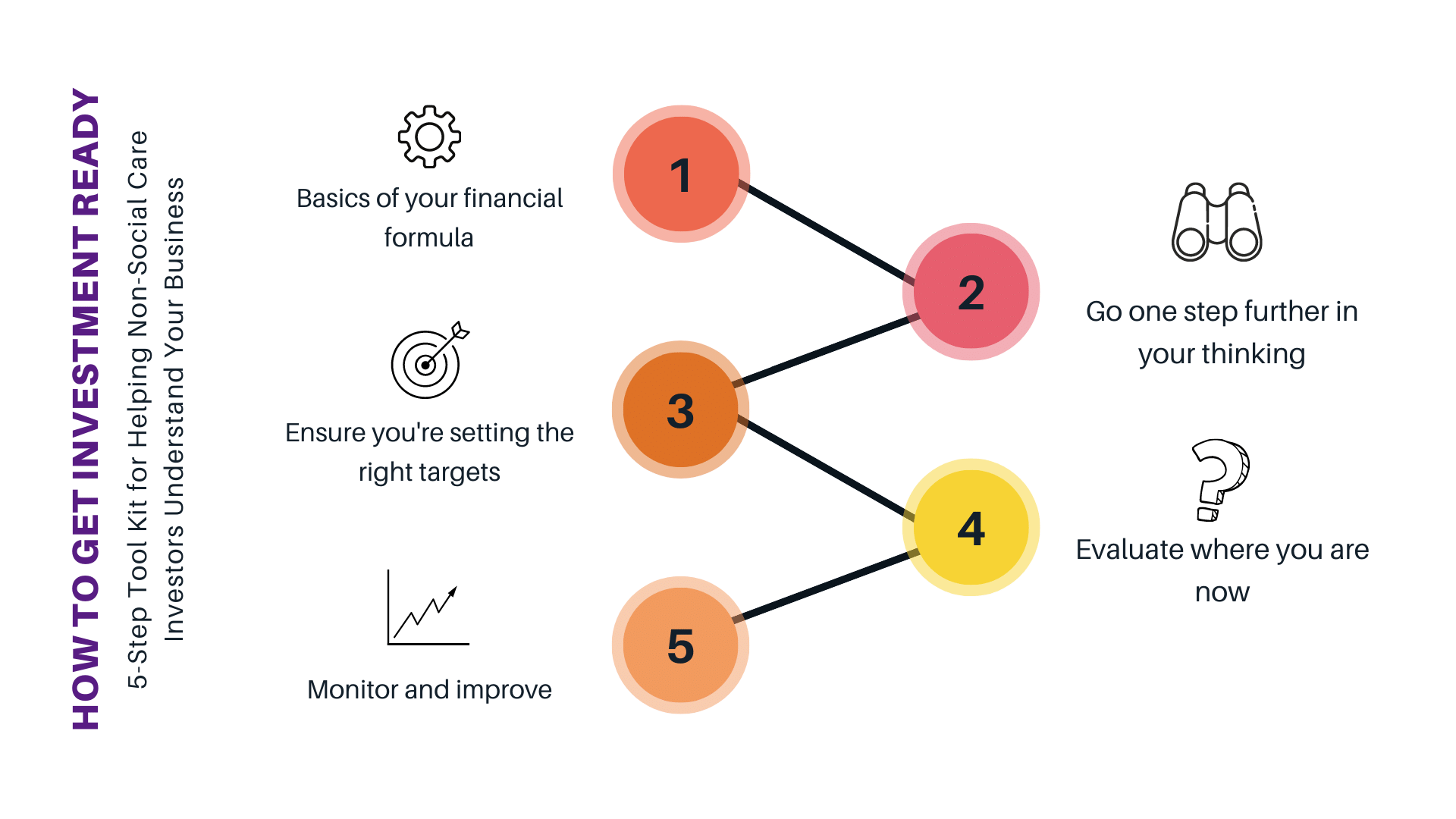

5 Steps To Better Analysis

In this article, I’ll lay out a 5-step approach for how to do this effectively. Whether followed formally or informally, this is exactly the type of approach you need to be following as a board member, leadership team member or business owner (in any sector). Ask the right questions, be rigorous in looking for the evidence for your answers, and course-correct where needed. Following this approach will ultimately help you grow your business and raise the bar for the sector.

This is simple, but that does not make it easy.

The Basics of your Financial Formula (the basic calculation that can trip people up)

Let’s start out by running through the basics of calculating operating profit.

Operating Profit = Care Home Revenue – Care Home Costs

Care Home Revenue = (Beds * Occupancy Level * Average Fee Level) + Additional Charges

Care Home Costs = Variable Costs (like Staff & Meals) + Fixed Costs (like Rent & Bills & Admin Staff) + Additional Costs (like Debt costs)

Example: A 50 Bed Care Home, with an average 80% Occupancy and £1,200 per week fee level (£62.4k/year), might look something like this

Revenue = (50 Beds * 80% Occupancy * £62.4k) + £100k Additional Charges = £2.596 million

Costs = £1.557m in Care Staff (60% of revenue) + £130k in Food (5% of Revenue) + £390k in Rent (15% of revenue) £130k in Fixed Utilities + £130k in Other Fixed Costs like back office staff, one-off costs, advertising = £2.337 million

Operating Profit of £259k, which equates to a 10% Operating Profit Margin.

Brilliant! Easy!

Every one of the >15,000 care homes in the UK will operate a variation on the above formula. All these numbers are perfectly reasonable, and this formula is relatively simple to use, so why do people get it wrong and why isn’t everyone in the sector making money?

Go one step further in thinking about your Financial Formula

The devil is most definitely in the detail, and to be effective, you need to go one step deeper to look at each variable or component of the formula. Ask yourself questions about your business and examine all internal and external factors impacting its performance.

Let’s take “Occupancy” as a single example

- Local Population & Demographics. How many prospects with the right age and demographic are in my target radius?

- Local Home Dynamics. Are there x3 other homes in a close radius that will increase competition and challenge a consistently high Occupancy?

- Can I define my channels for new residents, for example:

- Local Authority led? Do I have a strategy for communicating with the Local Authority to meet their needs over the long term? Do I use framework contracts with them? Will this guarantee me a base occupancy level? How do I manage the relationship?

-

- Private Pay led? Do I have a strategy for communicating with potential future residents? Is this local marketing-led, or group led? Does this focus on digital, hard or word of mouth marketing? Can I see a direct cost of this associated with attracting new residents?

-

- What were my levels in the past, and how have these evolved? If my care home has been dropping by 5% Occupancy every 5 years do I know the drivers?

-

- How do I manage the process for potential new residents? Do I have an effective Customer Relationship Management (CRM) platform to track this and manage follow-up for enquiries?

-

- How effectively do I manage the logistical process for filling new beds? Does marketing begin immediately or after a set period? Do I have internal systems that take time to update to allow this?

-

- Do I align my team to targeting Occupancy? Through targets or bonuses?

Answering these questions, to which there are no wrong answers, will give you the detailed understanding you need.

Repeat this process for each of the revenue and cost variables. By understanding and thinking about the key drivers carefully, you will have already made progress and you will be able to conquer any third party due diligence processes!

Set the Right Targets for Your Business.

This is the fun and exciting part; it’s what the future can hold for you and your business. I would suggest this step is tackled only after you have completed Step 2…otherwise, you may shoot for the wrong data points.

With that in mind, think about what you are trying to achieve as a business in a very simple 2 to 3 bullet point statement. Look at where you might already have a competitive advantage or might need to focus on closing a gap.

State What You Want to Achieve, For Example:

-

- Reach a 15% Profit Margin as that will allow you to continue to double your homes over 5 years.

-

- Increase average fee levels by 25% over 3 years, allowing you to increase quality and standards by 40% over the same period.

-

- Attract external investment (debt or equity) allowing you to expand your innovative service.

-

- Build a reputation as the highest quality provider in your area.

-

- Build a reputation as the highest quality provider in your area at a specific price point (e.g. under £1,000 per week).

-

- Be recognised as one of the top providers for attracting and retaining carer talent.

-

- Be recognised as a high-quality innovator in the sector/region.

Evaluate Where You Are Now and Design How You Will Reach Your Targets

By now you will have a considered understanding of the key drivers for your business, and a refreshed view of what’s important for your business to achieve.

How do you know if you are doing well against your target goal, or are on the right track?

You should be rigorously looking at the data that supports your targets on a granular level to take the view on whether you are getting closer or further away, and why.

If this is the first time running this process in a rigorous manner, it is possible that you suddenly find that some of your goals were mutually inconsistent because of the underlying drivers or interlinks in your business. Equally, you may find some secret gems in the business that suggest re-aligning the goals could play to your strengths to a much greater degree.

Re-aligning Goals and Finding Secret Gems, For Example:

Reach a 15% Profit Margin as that will allow you to continue to double your homes over 5 years.

- Your starting analysis tells you you’ve averaged 10% over the last 3 years. However, when digging into each of the core components of your Operating Profit as above, you might see that all key variables are operating at/around industry averages or levels you are happy with and consistent with the 15% target – except for Agency Costs, and more specifically, Agency Costs in the Winter months. You notice that the winter spike alone in Agency Costs loses 6% of the annual margin.

- In addition to your standard monthly reporting, a New Pillar of targeted indicators becomes around Agency Staff use. This might include a specific dashboard covering your bank of available (non-Agency) staff, both ongoing, and used in the last 3 months. How many care staff have been trained, why leavers leave, trends broken down by site.

- This will also allow you to try new interventions – it might be anything from a new taxi policy (the carers were remote and didn’t like travelling in winter), to planning ahead with a block reservation with an Agency in the summer at cheaper rates to manage the winter period, to investing in a recruitment drive.

- Most importantly, every single month you will be able to see the efficacy of these interventions. Some will work, some won’t. but no longer will you be sitting there in February, surprised at seeing the Operating Profit figures looking so low after a bad few months.

Constantly Monitor & Improve – The Importance of Data Quality, Consistency and Systems

What you have now is a handful of data points that you have just analysed, that you can collect easily, share and monitor as a team on a regular (e.g. monthly) basis. It is vital that these are quick to collect so that your information is in real-time. If it is a hassle, after a few months it will likely fall into disuse. If it is lagged information, then it can be like trying to drive using the rear-view mirror…better than nothing, but you might still miss the turning.

If you have identified the right targets and supporting data points, they will help you drive the business as a team, and also create a shared language for the business, the goals and the key drivers.

Next time you are in a Board Meeting, try running through the above. I guarantee you will find it illuminating, and hopefully useful.

If you’d like to speak with John Lanyon more about how to get your care home investment or sale ready, you can connect with him on LinkedIn or email hello@kareinn.com.

More about John:

As the CEO of a global corporate financial advisory firm, John has spent many years working with businesses in a range of sectors including technology, healthcare and energy, in the UK and globally. For the last 13 years, John was also a lead volunteer member of the Alzheimer’s Society research community, helping to fund and work with academic researchers in dementia care, cure and prevention. John founded KareInn to deliver tangible outcomes for people living with dementia. He has also developed the Partnership Framework for Social Care as a means to help other social care businesses join the rapid transformation in social care.